For the adept poker player, no two hands are ever played the same way. A…

Beating The Bad News Baloney

By Michael Knights, Horizon Property Alliance

If you’ve read a paper in the past six months, you’d be forgiven for thinking Australia’s property market is headed for Armageddon, destined to fall into a gaping chasm of despair that will render useless the wealth-building plans of anyone foolish enough to have purchased.

Unfortunately, this sensationalised BS can be self-fulfilling, but there is a way to look beyond the waffle and not only purchase property at an enviable price but make a handsome long-term gain as well.

Don’t believe the anti-hype

The first step toward success is to stop believing what you read.

Sensationalism sells papers – pure and simple.

These bad news bearers are trying to drive eyes to their pages and websites with little regard to facts. Fortunately, if you can look beyond this misinformation and run your own race, you’re set to enjoy the upsides.

Reliable cycle

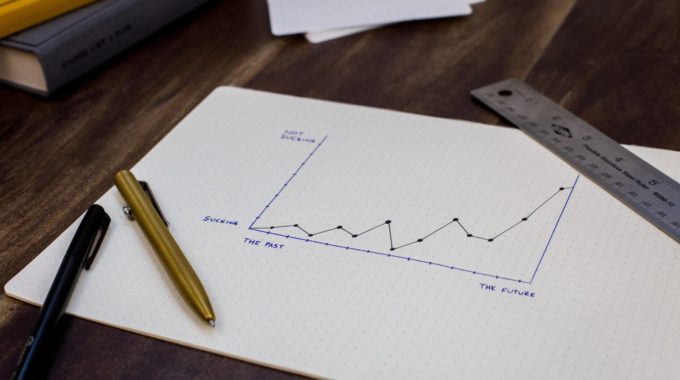

After decades as a property professional, I can guarantee the cycle we are seeing today is no different to how real estate has performed historically. The thing to realise is markets move in cycles – always has and always will.

Property values rise and momentum runs in response to positive drivers – population growth, low interest rates, rising employment numbers, high overseas and interstate migration – myriad factors combine to interact and create demand that’s outstripping supply.

Markets will eventually soften as demand dries up a little and values retreat in response. Bad media follows, confidence is zapped, and buyers leave the market while sellers get nervous about achieving sales.

Prices and supply will eventually find their bottom where buyers will once again start to take notice. It is a cycle and it is repeating regardless of what newspapers, radios or TV say.

The secret to success

In all this hoopla, there’s one element that’s rarely mentioned, but is key for those looking to enjoy the upswing.

There is no such thing as a single Australian property market.

Every state, every city and every suburb – right down to every street – has its own property cycle and great buying opportunities.

A market adjustment is actually good news for those who are ready to get in.

Even different types of properties have their own cycles. Units, townhouses and houses, off-the-plan and land subdivisions all have their time in the sun and are on varying paths of price movement over a variety of timeframes.

If you know what to look for and where to buy, you should be excited.

Is now the time?

Most definitely – in fact, it’s always “now” somewhere because even if you believe one market is on the downswing, there’s another opportunity elsewhere. The key when investing is to know your personal “why” for buying at this particular moment.

Define the reason you’re looking to invest and then seek the venture that will best fit your requirements. It will not matter if the market drops temporarily and it will be a bonus when over time it grows in value.

You must have a blueprint in place before entering the market. A long-term plan and an exit strategy, a back-up solution just in case something goes wrong is very important, too.

No one has a failsafe crystal ball, so always ensure you protect yourself and your assets. I also believe you need a valid and compelling reason if you decide to sell, too.

Assets will make you money and liabilities will hold you back, so carefully assess your holdings to ensure you don’t keep property that’s costing, rather than making, you money.

Be prepared and take actions

The way to take advantage of an opportunity is to be prepared to jump on it.

Organise conditional finance pre-approval or have the cash in the bank ready to go – perhaps from an offset account.

This means you aren’t rushed into a decision to complete and can sign contracts with confidence. Best of all, when you spot a brilliant deal you can jump on it before anyone else. Whether a market is rising or falling, a street-smart, well-educated buyer will be ready to swoop in on an investment opportunity.

Also, do your research and understand your market, but also learn to trust those experienced advisors on your team.

They’re the ones who have your back and can ensure you are purchasing the right property for your circumstances ever time. Finally, stay the course.

Ensure your investing journey has been mapped out as a long-term plan so you can get the best out of every holding in your portfolio. Just so long as you act when opportunities present themselves – when you find the right property, sign a contract and buy it.

If you do nothing, then nothing changes.

If you trust your gut, if you’ve done the research and the property stacks up, you will come out ahead. Smart investments are made every day whether the market is rising or falling.

So, if you love talking about property investing as much as myself, feel free to contact Michael Knights of Horizon Property Alliance on 0409 018 778.

LIVE CASE STUDY

One of our buyers will make approx. $195,000 profit in 6 – 9 months!!!

We are currently about to start construction on another duplex project.

Sometimes, it’s not what you know, but who you know.

This project was offered to us first before it was even on the market.

This is called an “off the market transaction”

Consider treating your investment, as a business.

Here are the numbers;

This will be a full complete turnkey package, at wholesale price.

2 + 3 bedroom lowset duplexes with a purchase price of $635,000 on completion the estimated approx. retail price will be $830,000. Approx. $195,000 in gross profit.

During our research, we found a similar 3 bedroom, brand new duplex, standalone that had just been sold for $415,000. So when deciding on a project like this one, always make sure that you confirm with independent agents on the actual resale retail price,

Note: The resale retail price, is the completed product after construction.

It is important, not too take the agent who is selling you the properties word on the expected profits, until you have done your research.

We always get 3 or 4 external agents market opinions on the resale retail price in all of our projects like this one, the numbers have to stack up or we walk away from the deal.

The return on your investment for these types of opportunities, must be a minimum of 20 to 40% on your investment price.

We also recommend that the rent on the investment be from 6 – 7% plus return.

This will allow your project to be positively geared and a long-term safe option.

If you are interested in buying a property like this, please do not hesitate to contact us.

“Our clients choose us because we offer a professional stress-free service, that will save them time and potentially reduce their spend and increase their profits by thousands.”