For the adept poker player, no two hands are ever played the same way. A…

Perth Property Outlook – January 2017

There hasn’t been much joy in the Perth property market for a few years but according to property analyst Gavin Hegney, the overall property market should start to show signs of recovery in the first six months of 2017.

Mr Hegney said it was an interesting time in the market.

“In 1990 we had a recession, the economy was going down, unemployment was rising, interest rates were at 16 per cent,” he said.

“That is not the situation now – but you can crunch the numbers all you like, the residential market is based on emotion.

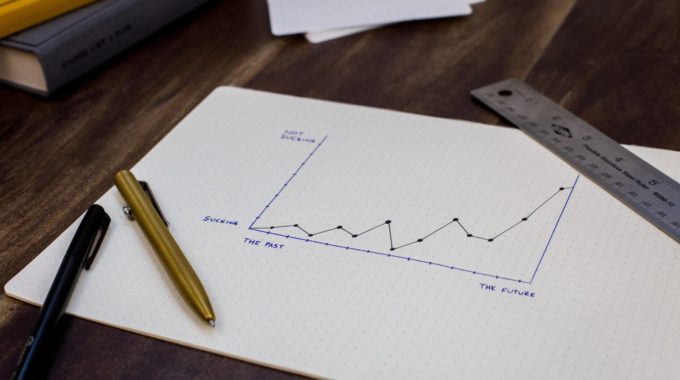

“People go through a cycle from optimism through to despondency/depression.

“Right now people are telling me it’s tough, saying things like ‘I bought this property a while ago, but it’s not doing anything, I just want to quit it, what should I do?’

“This is classic capitulation and next comes despondency and depression, but hope is around the corner and it will kick in.”

Speaking about the rental market, where the vacancy rate had risen and rents fallen significantly, Mr Hegney said the state of the market was not due to a collapse in the mining industry as generally thought, but an oversupply of property.

“The change in the first-home owner grant drove up supply of new homes,” he said.

“Migration has also fallen. We really only need one home for three people. If 30,000 people move to WA we need 10,000 homes; however we have been building 32,000.”

Mr Hegney said it was a good time for tenants to renegotiate leases, and was worthwhile for landlords to consider reducing rents. However, there were signs of change, with supply starting to dry up.

In the past 12 months there had been more building completions that commencements and the building market had also fallen 40 per cent. Low rents would also lead to smaller households, further reducing supply.

“When rents fall, people who have previously been sharing a home will seek out their own home and the vacancy rate will fall,” Mr Hegney said.

The same would apply to sales, where lower prices and interest rates would encourage people to buy.

When it came to property sales, over the past 12 months there were more properties for sale, but less sales. It was now taking 68 days on average to sell and first-home buyers were missing in action.

However, Mr Hegney said there was pent-up demand, with people holding back and waiting, which was a reflection of the emotional temperature of the market.

Mr Hegney said he expected the market to return to better times in approximately 2020.

He said there were indication that the market had reached the low point in the cycle and was changing, such as rezoning around transport, infrastructure development and redevelopment around football ovals.