For the adept poker player, no two hands are ever played the same way. A…

Is negative gearing doomed? House & Land – Why we don’t like them.

Positive Cash Flow

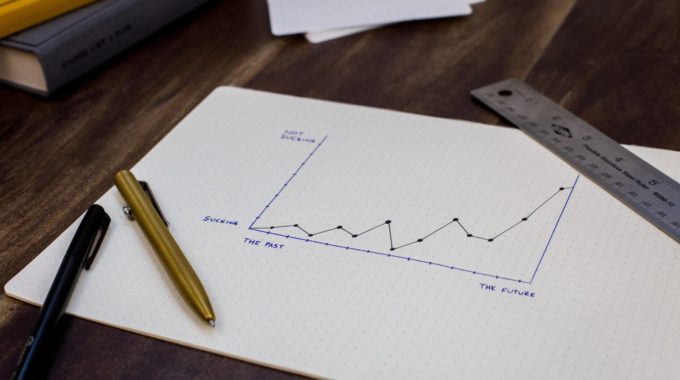

I’m here to say that negative gearing is doomed, and Positive cash flow is King.

It’s a controversial call, but let me break it down for you.

The average negative gearing scenario happens something like this:

Mr & Mrs Smith are making good money. They see their tax bill every year and it’s a shock.. they’re paying a lot. They really really dislike paying tax.

They head off to a seminar or speak to an advisor. They learn that some of the tax they are paying could be refunded back to their bank account. The so-called Property Gurus spruik about how the value of a house and land package could double over 7 years and the market will grow by 5% a year.What a load of garbage. Nobody has a crystal ball.

No way, this is old school and negative and in my opinion a big SPRUIK

You totally dislike paying too much tax, so you get persuaded into buying a house and land package with just a 5% yield. Perhaps you’ll get a rebate and pay down the debt, or draw some equity from the capital growth and pay down your personal home loan. They might even promise you a free car in the deal.

These fancy wealth plans get promoted and promises get made by the smooth-talking and potentially unqualified advisors. Most of these so-called advisors wear several caps and work under different ABN numbers and licenses that allow them to work in the unregulated new property market. Evading compliance issues, some even promote themselves under a governing regulated membership.

There is a massive conflict of interest, be aware and ensure you do your homework before doing any business or investing with a company like this. Seek out independent experts and ask each advisor to show and prove their wealth and what they are currently working on for themselves, click here to get the questions to ask your advisor.

Don’t Do It!

Most buyers who get caught buying in these type of properties fail.

You need to have above-average discipline with your money to really get all the benefits from negative gearing. You also have keep working hard to pay off the debt.

Our life journey changes all the time for good and bad. If something bad happens, everything can change overnight. It can get stressful, crazy and out of control.

When you buy a negatively geared property, you are married to the bank.

If unforeseen circumstances take you down and you stop earning an income, the banks still want their money. Their only job is to ensure the loan gets paid back. They’ll take the house back and the home you live in if you can’t find the money or fail to pay back the debt.

This is why investing in a positive cash flow investment property in the right location will beat a negative geared property every day.

Positive cash flow is king, in any market, boom or bust cycles, having positive cash flow investment properties is the safest way to invest.

You can sleep at night knowing if you are out of work, your property will still pay the way and stand alone.

Choose your strategy wisely

We are here to help, go for a positive cash flow investment property.

Talk to real investors who own them and talk to investors who don’t. Compare the difference.

Financial Advisors & Brokers – If this information resonates with you, let’s discuss mutually referring clients. More here. If you like & recommend negative gearing, we are not the right fit.

Investors – When did you last check in on your property investment strategy? We are always happy to audit your current strategy for free. See what we did for Mike & Leslie

We are currently breaking ground on a unique investment opportunity returning 14% -15%. We’ll tell you all about it over the coming weeks, or you can find out more here.

Until next time

Enjoy,

Michael Knights

Property Investment Strategist