For the adept poker player, no two hands are ever played the same way. A…

Boom or Bust – Corona Virus and is the Property Market immune?

Michael Knights, CEO, Horizon Property Alliance

The Cash rate has just been reduced to an unprecedented 0.5%! So what happens now?

Does this mean doom and gloom? or is the Australian property market standing strong?

As a realist in the Property market, I often get asked by many to share and predict my opinions in the market – when I do, I’ve have been spot on. (I’m sharing my predictions at the Alexandra Headland Surf Club in a few weeks at my next property workshop).

Here’s my unsolicited opinion of the current market as of today.

Is the Property market immune to the Coronavirus?

Is the Australian Property Market Immune to the Black Swan events like the Corona Virus? These type of Black Swan events can and have wiped out trillions of dollars from the stock markets and the industries that rely on trade and tourism. They affect all international sectors and a crash will create fear from the sensationalism of the media. . It sets off fear, disbelief, massive uncertainty and insecurity all over the world.

The stock market is unpredictable and out of anybody’s control both in a normal market and during Black Swan events. Mum and Dad investors fear the opinions and lack of transparency or responsibility from so-called professional advisors who are still getting paid to look after their money without any recourse. Unfortunately, professional advisors have no idea what the market will do.

Nobody does, Yet they are more than happy to take your money. In my opinion, it should be a true profit share agreement.

Not all advisors are equipped to carry responsibility, and the banks don’t have a reason to as they make money regardless of what the market does – in fact, the banks earn more money out of fear from the masses. (That is another story. Stay tuned for my next email.)

The stock market is like a big bag of money. When the market turns sour, the Big bag gets a hole in it and nobody can control the size of the hole, or how quickly the money will leak out of it. Nobody can patch it up – it’s leaking money right now, the investors money… Your money. In cycles the market reaches new highs and the bag will burst when it turns, or during uncontrollable events. Nobody can predict the money market or the stock market when this happens. The Property market is the same.

To create a positive side to a negative downturn, be ready to pounce on opportunities.

The banks still get paid if the market goes up or down. So can you if you know how, when and what to buy. Have a strategy and a plan.

In contrast, the Property Market is standing strong. Banks are reducing interest rates as low as 2.4% and may well go even lower. The Government is supporting first home buyers with free money and employment is relatively stable. The Government have created the NDIS which is starting to stimulate a new sector of the market, helping via Property and small allied health businesses, freeing up the medical and hospital system. An ecosystem is developing where the Government pays to give people with disability real options. A win-win for the country.

There is infrastructure spending is in the pipeline – it’s booked in and rolling out. This will create more jobs and opportunities throughout the nation.

Bricks and Mortar are a safe investment. Property is an even safer investment when it is structured and geared correctly to support everyday Australians – . What I really like about Property is that you have the control and there is never a shortage of tenants wanting to live somewhere.

Find out more at out Property workshop on the at the Alex surf club – Click here to join the session

If my opinions resonate with you, and you would like to learn how we are protecting our future by creating wealth through the property market, now is the time to take action.

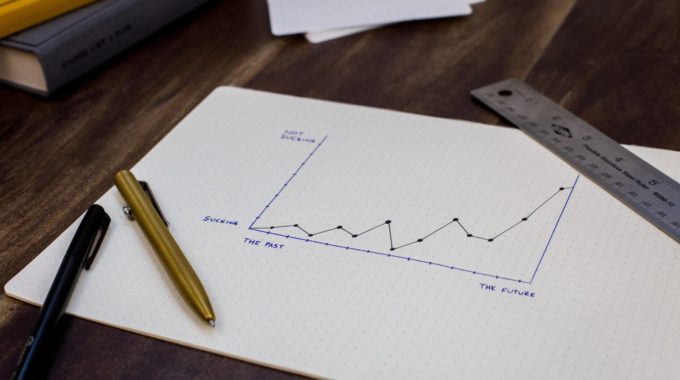

We are all in the box seat – get ready to take action, this could be one of the biggest buying opportunities for many years to come in my opinion – Regardless of whether the property market goes up or down. I don’t have a crystal ball, but I have a strategy and a goal.

New investors, well seasoned Investors looking to grow their portfolio, Downsizers, Property lovers, Agents & Financial Advisors – learn more about investing and how we are gearing up for the next phase in this exciting market.

Don’t forget our Alexandra Headlands property workshop on the 25’th – Click here for more information.

On the night we will show you live case studies and projects we are working on. Most projects show positive cash flow returns from 6.5% to 20% net returns

Those of you who do take action and plan to be free from the negative banking demands and create a passive income will have choices and the ability to enjoy the rewards that will follow.

Mike Knights

Learn about Michael Knights here or listen to his podcast with Property Investory